Payment Links overview

Introduction

The Payment Links product enables merchants to create and send links to a secure payment page hosted by Peach Payments. Send links to customers using email, SMS, WhatsApp, or a combination of the three.

Payment Links uses Checkout to accept payments and supports all the payment methods that Checkout offers.

Using the Peach Payments Dashboard or Payment Links API, you can:

- Generate a payment link or a batch of up to 1000 payment links.

- Add supporting documentation to payment links.

- Add terms of service to payment links and make it mandatory for customers to accept them before making payment.

- Query a payment or batch status.

- Retrieve all payment links and view their statuses.

- Download an export of up to 20 000 payment links.

- Cancel a payment link.

- Receive payment and batch updates via webhooks and successful transaction email receipts.

- Retrieve all error files for a batch.

Example payment link messages

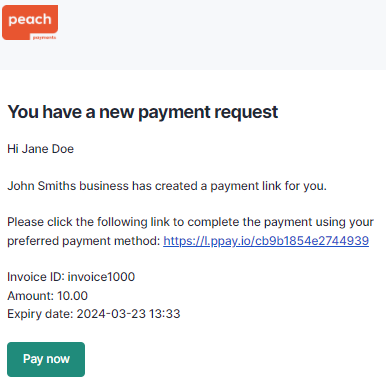

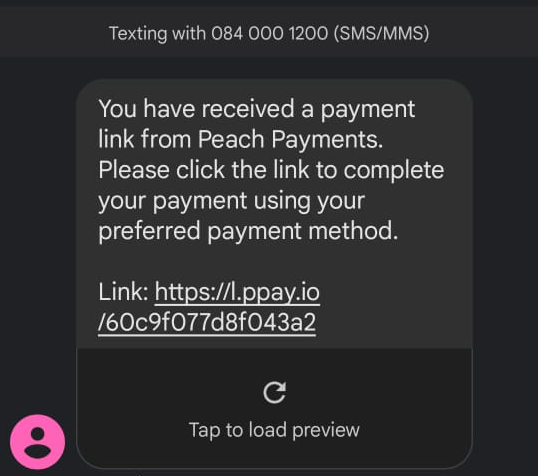

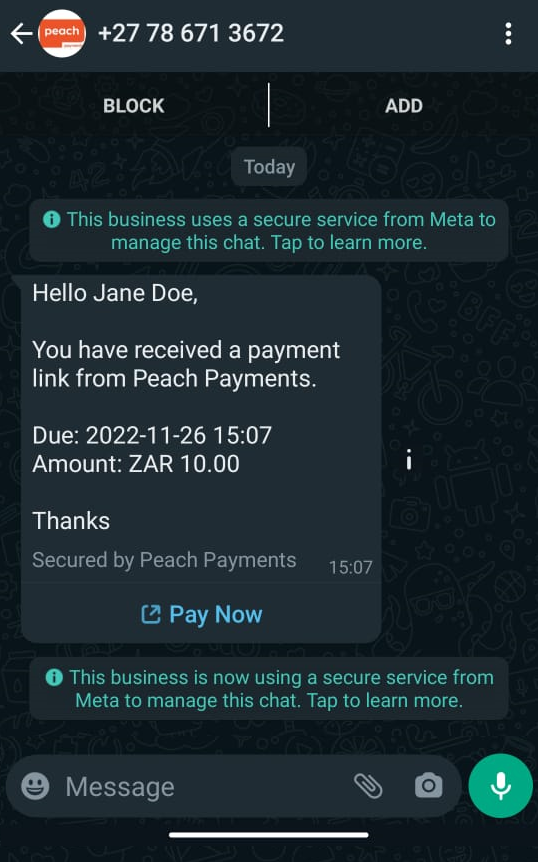

You can edit the email and SMS templates on the Payment Links Settings page, but not the WhatsApp template.

Payment link sent using email.

Payment link sent using email.

Payment link sent using SMS.

Payment link sent using SMS.

Payment link sent using WhatsApp

Payment link sent using WhatsApp.

Video showcase

The following video showcases the Payment Links product:

Quick links

| 📝 API playground Detailed reference to all the Payment Links API endpoints and mock calls. API reference | 🚀 Postman collection Use the sample Payment Links calls in Postman. See the collection overview for more information. |

| ⭐️ PHP SDK Use the PHP SDK to integrate with Payment Links. PHP SDK | Experiment with a JavaScript Payment Links sample integration project. Sample project |

Example use case

Instead of sending bank details and a PDF invoice via email, you can generate and send a payment link that automatically populates invoice and payment information and allows your customer to pay using a variety of payment methods.

Updated 7 days ago