Share via

Julep: A Flower Delivery Business that Thrives with Peach Payments

Julep is an online flower delivery business based in South Africa. The company was founded in 2019 by Julia Rosslee and her husband Nic. Julep sells a variety of flowers, including bouquets and arrangements through on demand and subscription methods through their ecommerce store. Unlike traditional florists, Julep’s flowers are delivered in a long cardboard box to protect them during transit. Their blooms arrive ‘in bud’ (not yet fully open) so that they can be enjoyed for longer.

The Challenges of Selling Flowers Online

The flower industry is a competitive one, and selling flowers online can be challenging. One of the biggest challenges is that flowers are a perishable product. This means that Julep needs to be able to deliver flowers quickly and efficiently in order to ensure that they arrive fresh. To streamline their processes to provide the optimal customer experience, Julep uses Peach Payments to handle their online payments for both local and international customers. In addition to being highly recommended by fellow entrepreneurs, Peach Payments was chosen because of its competitive transaction fees, great service and the availability of multiple payment methods.

Using Payment Links to secure the sale

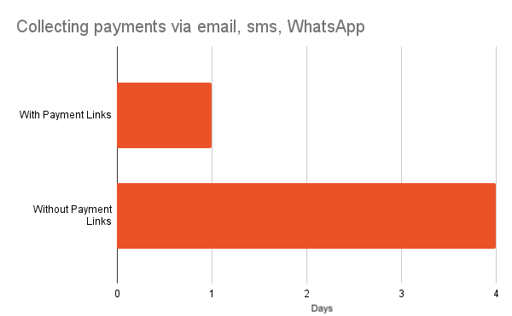

Payment Links is the ideal solution for Julep when it comes to offering their customers flexibility with their bespoke orders. Julep finds that sending a payment link is a safe, easy and convenient way to secure the sale by simply creating and sending it from their dashboard. In this way, customers can tailor their orders with little hassle adding to Julep’s dedicated focus on improving their customers’ experience.

Julia’s advice for other ecommerce businesses starting out:

“To get traction with customers, make sure you test your product rigorously in the market so that you receive valuable feedback and improve from there. Remember to keep your head down and keep iterating.”

Want to learn more about Payment Links? We’ve got something just for you.

Scale with Peach

Learn how we help scale some of Africa's most exciting businesses

Business tips, case studies, interviews with online store owners and business trends…

Peach Payments and Yoyo add bank card-linked loyalty to Digit Pro POS device

Black Friday up 93% over 2024, R1,86bn processed

Bringing Our New Peach Values to Life

Samsonite in-store payment methods

How global and regional companies can use the Mauritius IFC to centralise online payments and treasury functions

# PeachFriday Merchant Deals 2025

A merchant’s guide to chargebacks

Four Black Friday payment realities for merchants

What are Direct Merchant Accounts (ISO) versus Aggregation Accounts?

What Is 3RI? Everthing you need to know about Requestor-Initiated Authentication

Highlights from the 2025 World Wide Worx Online Retail Report

What is Interchange? Everything you need to know about interchange fees

Cadana Pay x Peach Payments: Unlocking seamless global Payouts

Peach Payments announces real-time clearance Payouts

Peach Payments x MoneyBadger partnership goes live

Peach Payments launches enterprise-level POS terminal

iTickets x Peach Payments Point of Sale

Peach Payments x Digicape: Powering Premium Apple Experiences with Seamless Payments

Peach Payments acquires West-African payments gateway PayDunya

Navigating International Transactions

Seize the Sale with Buy Now, Pay Later

2024 Wrapped: A Year of Innovation and Growth at Peach Payments

RCS payment option now available through Peach Payments

Peach Payments sees impressive growth this Black Friday Weekend

#PeachFriday Merchant Deals 2024

Your Ultimate Guide to Payment Security for Black Friday

Scaling with Peach Payments: Unveiling the Product Roadmap

Scaling with Peach Payments: Revolutionising Reconciliation

Scaling with Peach Payments: The Future of Payments

Scaling with Peach Payments: How Peach Payments is Keeping Your Business Safe