Share via

In our last blog, we explored the evolution of payment security and the importance of protecting your entire digital ecosystem. Today, we’re zooming in on the practical steps you need to take as a merchant to ensure you’re aligned with PCI DSS v4.0, the latest iteration of the payment security standard. Spoiler alert: it’s not just about checking boxes; it’s about future-proofing your business against evolving cyber threats.

How to Prepare for PCI DSS v4.0

- Know Your SAQ Forms:First things first—compliance starts with understanding which Self-Assessment Questionnaire (SAQ) applies to your payment setup. The form you fill out depends on how you process payments:

- SAQ A-EP Form: For merchants who receive card data directly on their website and pass it to a third party through server-to-server integration.

- SAQ-A Form: For merchants using a hosted or embedded checkout (like a redirect or iFrame).

- Secure Your Web Environment:

Running an eCommerce site means hackers are always knocking at your door. So, how do you keep them out? Start with the basics:- Implement a web application firewall and follow secure coding practices.

- Perform regular vulnerability scans and apply security patches to your website.

- Keep Software Updated:

You know that annoying little pop-up reminding you to update your software? Yeah, it’s not just a nuisance—it’s a lifeline. Ensure that your eCommerce platform and CMS are always up-to-date, and don’t neglect those plugins and themes. They’re often the weakest link in your security chain.- Ensure your ecommerce platform and content management system (CMS) are always up-to-date.

- Keep all plugins and themes patched with the latest security updates.

- Monitor for Vulnerabilities:

The bad guys are getting smarter, which means you need to stay two steps ahead. Set up automated scanning tools to keep an eye out for vulnerabilities 24/7. It’s not enough to just check in periodically—you need to know about issues the moment they arise.- Use automated scanning tools to regularly check for weaknesses on your website.

- Act quickly to patch any vulnerabilities that could expose sensitive payment data.

- Review Your Third-Party Providers:

Your payment security isn’t just about what’s happening on your website. If your third-party partners aren’t PCI DSS compliant, their vulnerabilities can become your vulnerabilities. Do your homework, and confirm that they’re meeting the standards, too.- Confirm that all your payment-related partners are also PCI DSS compliant. Any gaps in their security could impact yours.

How Peach Payments Supports Your Compliance Journey

Luckily, you don’t have to navigate PCI DSS v4.0 compliance alone. Peach Payments takes much of the heavy lifting off your shoulders.

- PCI DSS Level 1 Certified: Our platform is PCI DSS Level 1 compliant, which means we meet the highest standards of payment security, reducing the scope of your compliance efforts.

- Iframe Integration: Our iframe solution keeps sensitive cardholder data off your servers, significantly reducing your PCI DSS scope and making the SAQ A-EP process easier for you.

- Security Scanning & Vulnerability Management: We perform regular security scans and vulnerability assessments of our systems.

- Compliance Support: Our dedicated team provides resources, documentation, and guidance to help you navigate PCI DSS v4.0. We’re with you every step of the way, ensuring you meet your obligations and protect your customers.

Securing just the payment form isn’t enough anymore. With the rise of e-skimming and other cyber threats, PCI DSS v4.0 requires merchants to secure their entire digital environment. At Peach Payments, we take the hard work out of compliance, ensuring your systems are secure while guiding you through the necessary steps to meet the new requirements.

March 2025 is the deadline for full compliance, so now’s the time to act and lock every door and window of your digital house. We’ll be sharing more insights in the coming months on how Peach Payments helps merchants comply with the new future-dated requirements.

For more details on PCI DSS v4.0, visit the PCI Security Standards website

To learn more about how we protect merchants today, check out our Security at Scale page.<\/p>

Scale with Peach

Learn how we help scale some of Africa's most exciting businesses

Business tips, case studies, interviews with online store owners and business trends…

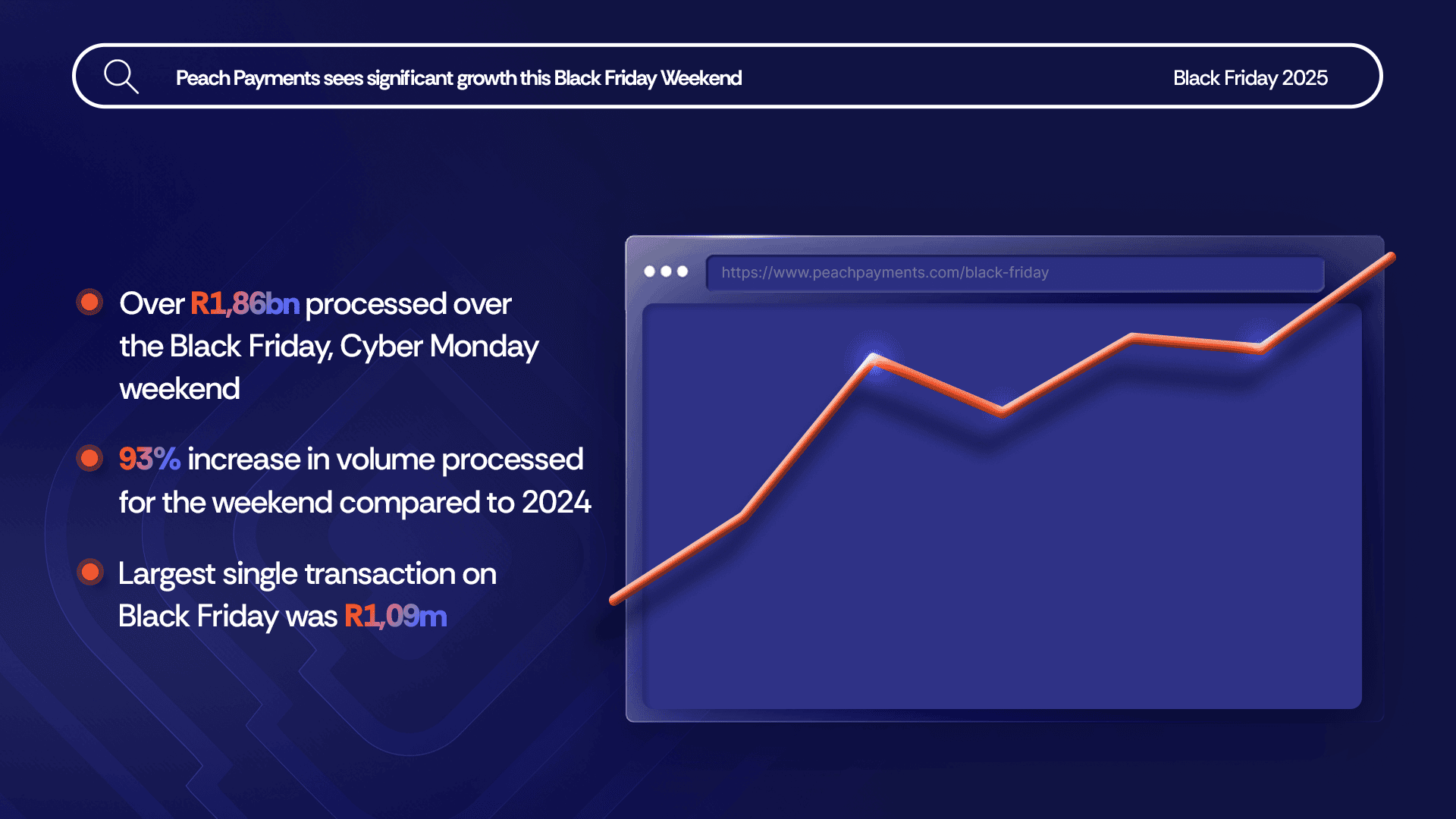

Black Friday up 93% over 2024, R1,86bn processed

Bringing Our New Peach Values to Life

Samsonite in-store payment methods

How global and regional companies can use the Mauritius IFC to centralise online payments and treasury functions

# PeachFriday Merchant Deals 2025

A merchant’s guide to chargebacks

Four Black Friday payment realities for merchants

What are Direct Merchant Accounts (ISO) versus Aggregation Accounts?

What Is 3RI? Everthing you need to know about Requestor-Initiated Authentication

Highlights from the 2025 World Wide Worx Online Retail Report

What is Interchange? Everything you need to know about interchange fees

Cadana Pay x Peach Payments: Unlocking seamless global Payouts

Peach Payments announces real-time clearance Payouts

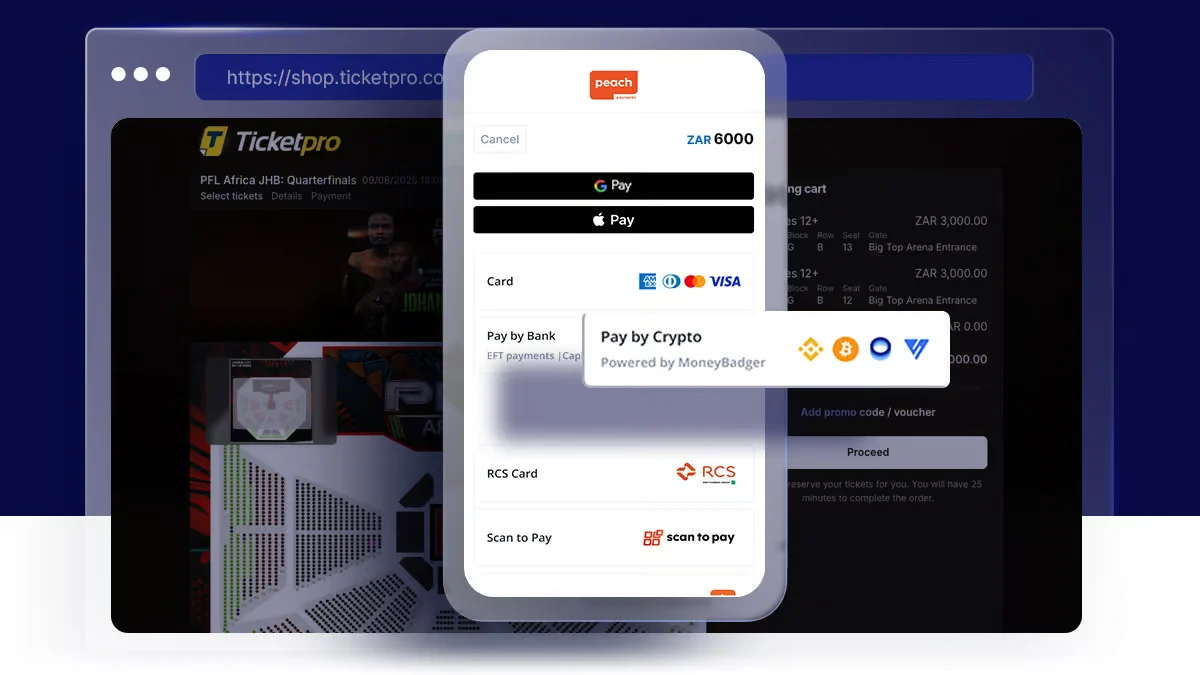

Peach Payments x MoneyBadger partnership goes live

Peach Payments launches enterprise-level POS terminal

iTickets x Peach Payments Point of Sale

Peach Payments x Digicape: Powering Premium Apple Experiences with Seamless Payments

Peach Payments acquires West-African payments gateway PayDunya

Navigating International Transactions

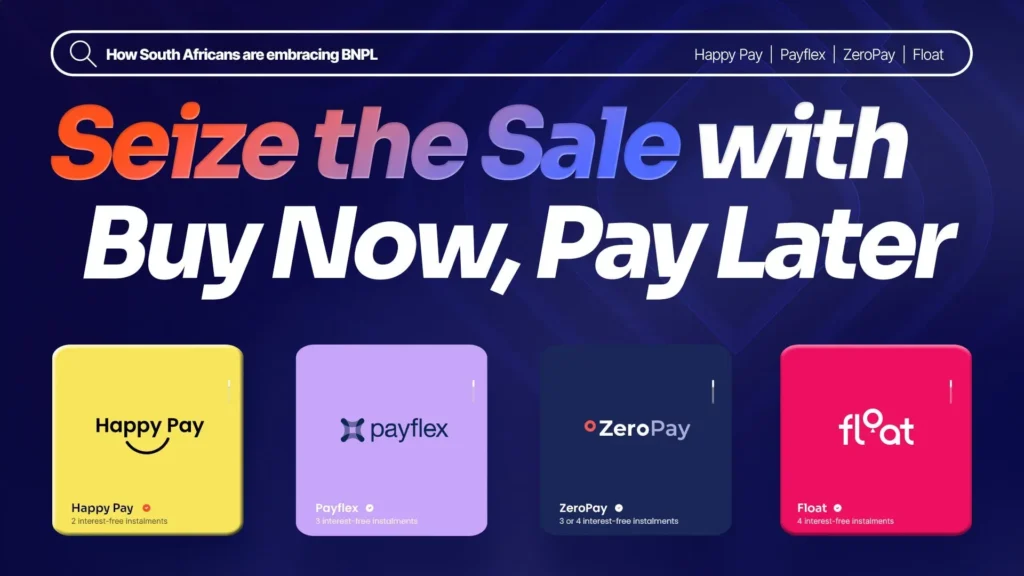

Seize the Sale with Buy Now, Pay Later

2024 Wrapped: A Year of Innovation and Growth at Peach Payments

RCS payment option now available through Peach Payments

Peach Payments sees impressive growth this Black Friday Weekend

#PeachFriday Merchant Deals 2024

Your Ultimate Guide to Payment Security for Black Friday

Scaling with Peach Payments: Unveiling the Product Roadmap

Scaling with Peach Payments: Revolutionising Reconciliation

Scaling with Peach Payments: The Future of Payments

Scaling with Peach Payments: How Peach Payments is Keeping Your Business Safe

Scaling with Peach Payments: Insights from the Think Bigger Summit 2024