Share via

We’re a payment gateway that strives to remove admin for our merchants and help them do more with their time. Recently, we released our new Payment Links product, which helps customers pay our merchants from anywhere. Now, we’re thrilled to announce two further updates to Payment Links: the bulk uploads and terms of service features.

Bulk Payment Link Uploads

Merchants can now simplify their workflows and improve their processes by utilising our bulk payment link upload feature. Simply upload a CSV containing the relevant details and send all your payment links at once.

- Merchants can create bulk links through the Dashboard or API using CSV files (the uploaded bulk file should have a maximum of 1000 rows)

- Payment links will be created based on data pulled from a filled row in the CSV file. There is a helpful sample CSV file in the dashboard that merchants can download and use

- Payments made through created batch links can be identified using the PAYMENT_BATCHLINKS custom parameter.

- Merchants using the API can see results of the batch send, including the state, how many rows were processed, and how many rows were successful.

- If a merchant uses the Dashboard, they will see the status of the batch in the Dashboard. If there are batch errors, details about those errors will appear in the Dashboard as well. Merchants can download the error files (rows.csv) and error details (details.txt) directly from the Dashboard.

For more information and a walkthrough on how to use the bulk uploads functionality, watch our Bulk Payment Links Video below:

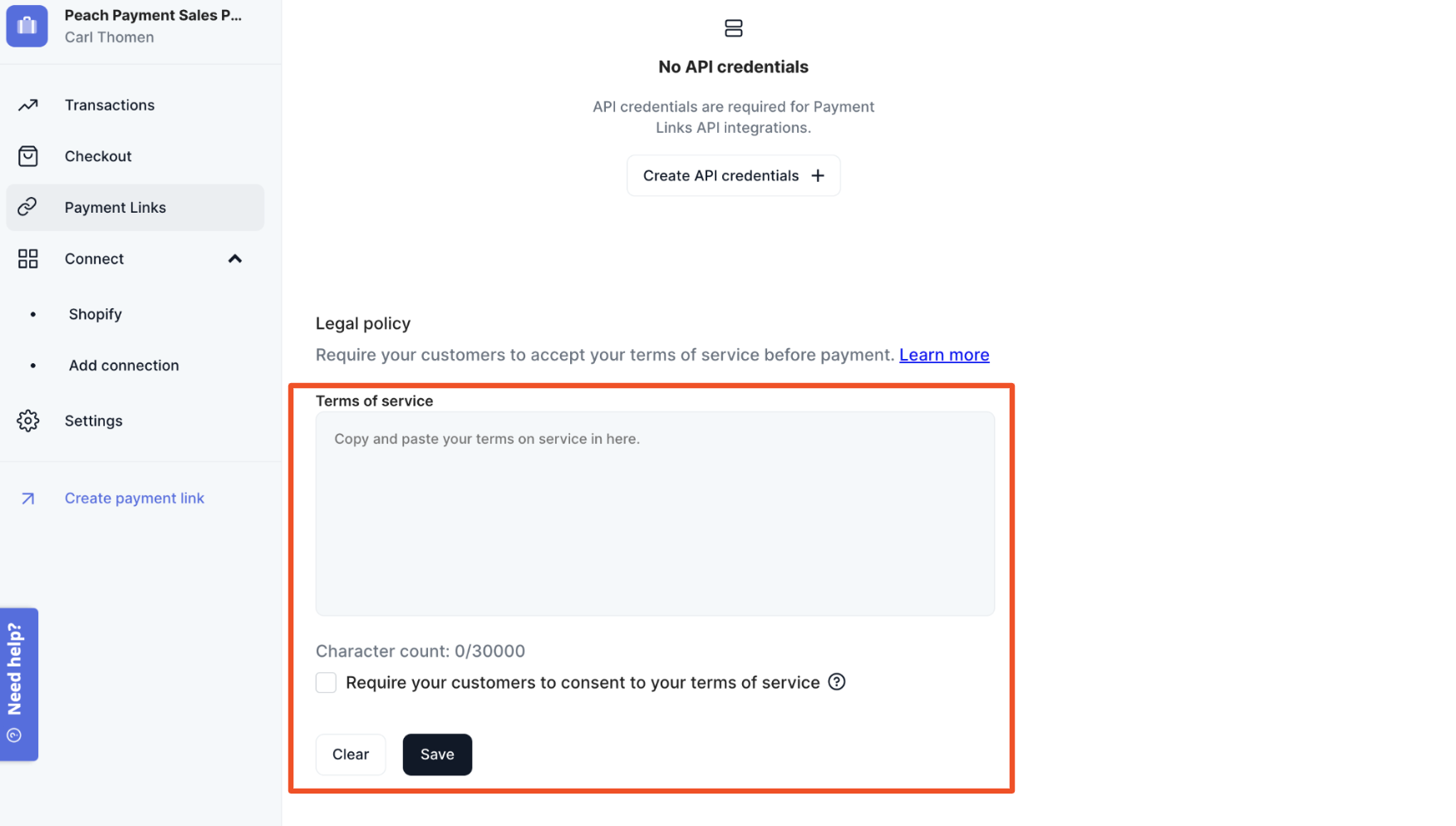

Terms of Service

Merchants using Payment Links can now also add their Terms of Service to the Dashboard under the Payment Links Settings page. This helps merchants ensure customers paying through Payment Links are aware of their Ts and Cs, both in general and also if customers have not encountered those Ts and Cs on the website or elsewhere.

This is important for a number of reasons:

- Legal and Compliance: Being able to add a legal policy to a payment link ensures merchants can comply with relevant laws and regulations, such as consumer protection laws, privacy laws, and anti-fraud regulations, if required.

- Transparency: A legal policy informs the customers about the terms and conditions of the transaction, including any fees, refund policies, and privacy policies. This transparency helps build trust with customers, which can ultimately lead to repeat business.

- Risk Management: Including a legal policy in a payment link can help mitigate the risk of disputes or chargebacks. By clearly outlining the terms and conditions of the transaction, there is less room for confusion or misunderstanding between the merchant and their customer.

- Liability Protection: A legal policy can also help protect the merchant from liability in the event of a legal dispute. By including a clear and comprehensive legal policy, merchants can demonstrate that they have taken steps to inform customers about their rights and obligations.

To add your Terms of Service to your payment links, simply click the Payment Links tabs in your dashboard and scroll down until you see the Terms of Service box near the bottom. You can then copy and paste your Terms of Service text into the box, and decide whether you want to require your customers to consent to them before making the transaction.

Scale with Peach

Learn how we help scale some of Africa's most exciting businesses

Business tips, case studies, interviews with online store owners and business trends…

Black Friday up 93% over 2024, R1,86bn processed

Bringing Our New Peach Values to Life

Samsonite in-store payment methods

How global and regional companies can use the Mauritius IFC to centralise online payments and treasury functions

# PeachFriday Merchant Deals 2025

A merchant’s guide to chargebacks

Four Black Friday payment realities for merchants

What are Direct Merchant Accounts (ISO) versus Aggregation Accounts?

What Is 3RI? Everthing you need to know about Requestor-Initiated Authentication

Highlights from the 2025 World Wide Worx Online Retail Report

What is Interchange? Everything you need to know about interchange fees

Cadana Pay x Peach Payments: Unlocking seamless global Payouts

Peach Payments announces real-time clearance Payouts

Peach Payments x MoneyBadger partnership goes live

Peach Payments launches enterprise-level POS terminal

iTickets x Peach Payments Point of Sale

Peach Payments x Digicape: Powering Premium Apple Experiences with Seamless Payments

Peach Payments acquires West-African payments gateway PayDunya

Navigating International Transactions

Seize the Sale with Buy Now, Pay Later

2024 Wrapped: A Year of Innovation and Growth at Peach Payments

RCS payment option now available through Peach Payments

Peach Payments sees impressive growth this Black Friday Weekend

#PeachFriday Merchant Deals 2024

Your Ultimate Guide to Payment Security for Black Friday

Scaling with Peach Payments: Unveiling the Product Roadmap

Scaling with Peach Payments: Revolutionising Reconciliation

Scaling with Peach Payments: The Future of Payments

Scaling with Peach Payments: How Peach Payments is Keeping Your Business Safe

Scaling with Peach Payments: Insights from the Think Bigger Summit 2024