Share via

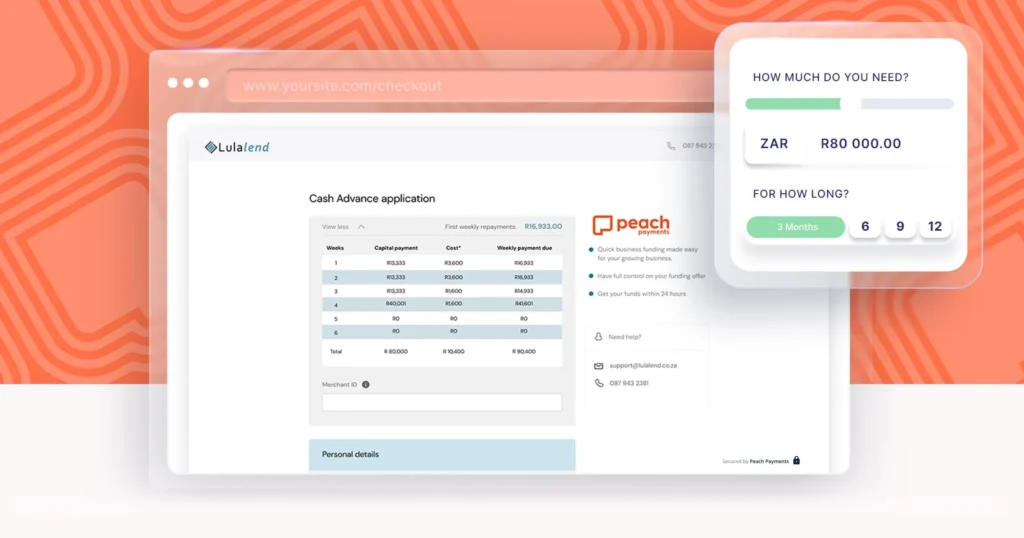

In the ever-changing business landscape, business owners often find themselves at a crossroads where they need to make difficult financial decisions. An avenue that has gained popularity in recent years is a business cash advance. While some view it as a financial lifeline, others approach with caution. Here, we’ll delve into business cash advances and shed light on their potential benefits while offering practical advice on how to determine whether they are the right fit for your business.

What are business cash advances?

Business Cash advances have emerged as a flexible financing option, providing businesses with quick access to capital when needed most. Unlike traditional loans, cash advances offer a more streamlined application process, with minimal paperwork and faster approval times. This immediacy makes them an attractive option for businesses facing urgent financial needs, such as unexpected expenses or opportunities for growth.

One of the primary advantages of cash advances is their speed. Traditional loans can take weeks or even months to process, leaving businesses stranded in the face of time-sensitive situations. Cash advances, on the other hand, are designed for rapid deployment, ensuring that funds reach your account swiftly. This speed can be a game-changer, allowing your business to react promptly to market changes or capitalize on emerging trends.

Assessing Your Business Needs

While cash advances can serve as a valuable tool in times of need, they should be part of a broader financial strategy. Building a sustainable financial plan involves careful budgeting, strategic investment, and continuous monitoring of your business’s fiscal health. Conduct a comprehensive analysis of your business’s cash flow and revenue projections. Understanding your repayment capacity will help you avoid potential financial strain down the road.

Consider the purpose for which you require additional funds: Are you looking to bridge a short-term cash flow gap, invest in inventory, or seize a time-sensitive opportunity? Understanding your financial goals will help you determine whether a cash advance aligns with your immediate requirements.

While the quick infusion of capital is undoubtedly appealing, it’s essential to carefully evaluate the costs and terms associated with cash advances. Take the time to understand the terms of the agreement, including any fees, and calculate the total cost of the advance. This transparency is key to ensuring that the benefits of the cash advance outweigh the associated expenses.

Maximizing the Impact of Your Cash Advance

Bridge an anticipated gap:

If your revenue tracking shows that you can expect a temporary dip in the near future due to seasonality or other factors, a cash advance can help you keep your businesses running day-to-day until revenue picks back up.

Strategic Marketing Initiatives:

Invest a portion of your cash advance in targeted marketing campaigns to boost brand awareness and customer acquisition. This could include digital marketing efforts, social media advertising, or even the development of a new marketing strategy to reach a broader audience.

Upgrading Technology and Infrastructure:

A technologically advanced business is better equipped to streamline operations and enhance customer experiences.Allocate funds to upgrade your business’s technology infrastructure, whether it’s enhancing your website, implementing new software systems, or improving your point-of-sale systems.

Expansion Opportunities:

Consider using the cash advance to explore new markets or expand your physical presence: Open a new location, expand your e-commerce platform, or partner with new distributors.

Inventory and Stocking Up:

Bolster your inventory to meet growing demand or take advantage of bulk purchasing discounts. A well-stocked inventory ensures you can fulfill customer orders promptly, improving customer satisfaction and loyalty.

Employee Training and Development:

Invest in your team by providing training programs or professional development opportunities. A well-trained and motivated workforce can significantly contribute to increased productivity and overall business success.

Scale with Peach

Learn how we help scale some of Africa's most exciting businesses

Business tips, case studies, interviews with online store owners and business trends…

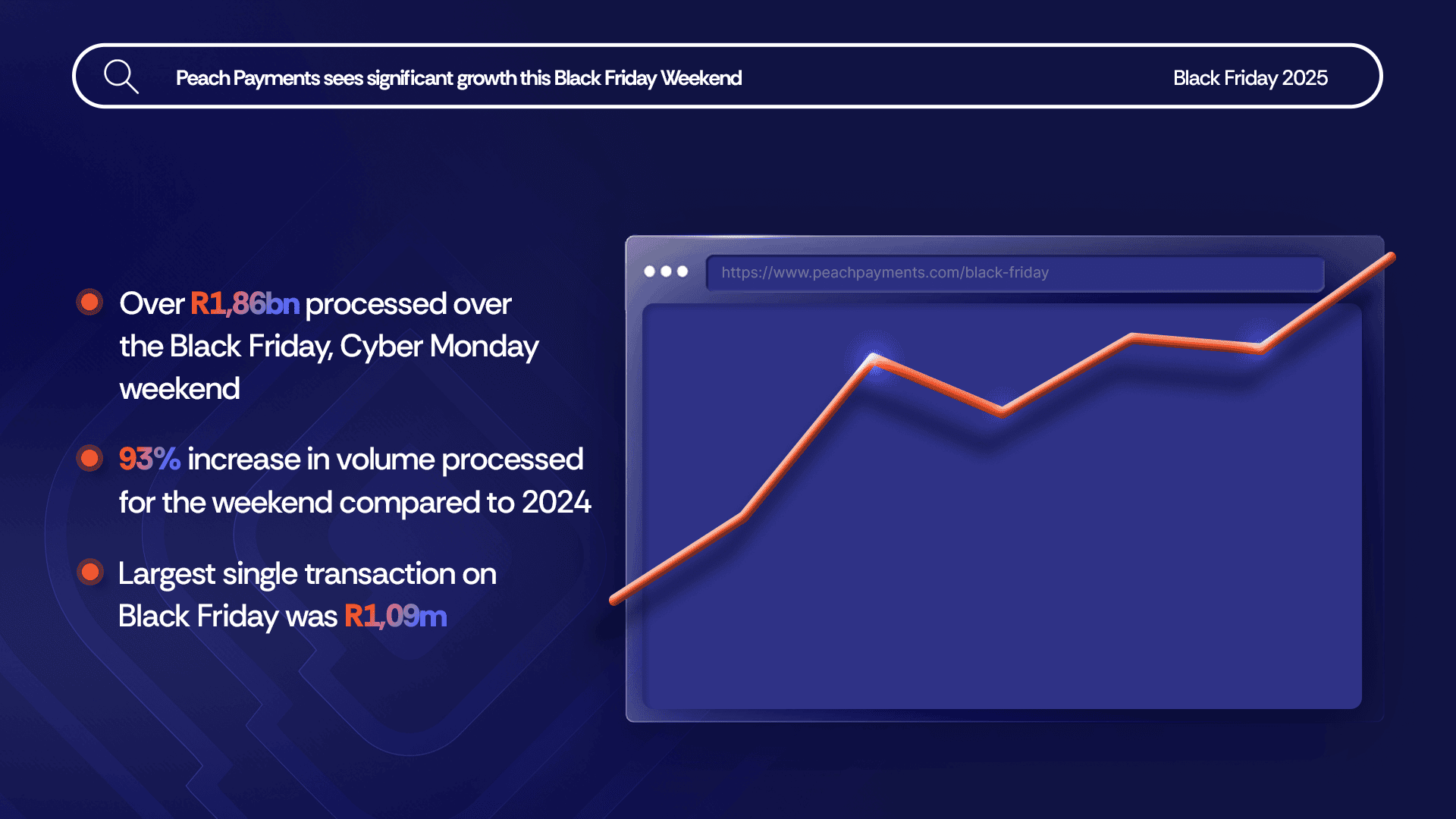

Black Friday up 93% over 2024, R1,86bn processed

Bringing Our New Peach Values to Life

Samsonite in-store payment methods

How global and regional companies can use the Mauritius IFC to centralise online payments and treasury functions

# PeachFriday Merchant Deals 2025

A merchant’s guide to chargebacks

Four Black Friday payment realities for merchants

What are Direct Merchant Accounts (ISO) versus Aggregation Accounts?

What Is 3RI? Everthing you need to know about Requestor-Initiated Authentication

Highlights from the 2025 World Wide Worx Online Retail Report

What is Interchange? Everything you need to know about interchange fees

Cadana Pay x Peach Payments: Unlocking seamless global Payouts

Peach Payments announces real-time clearance Payouts

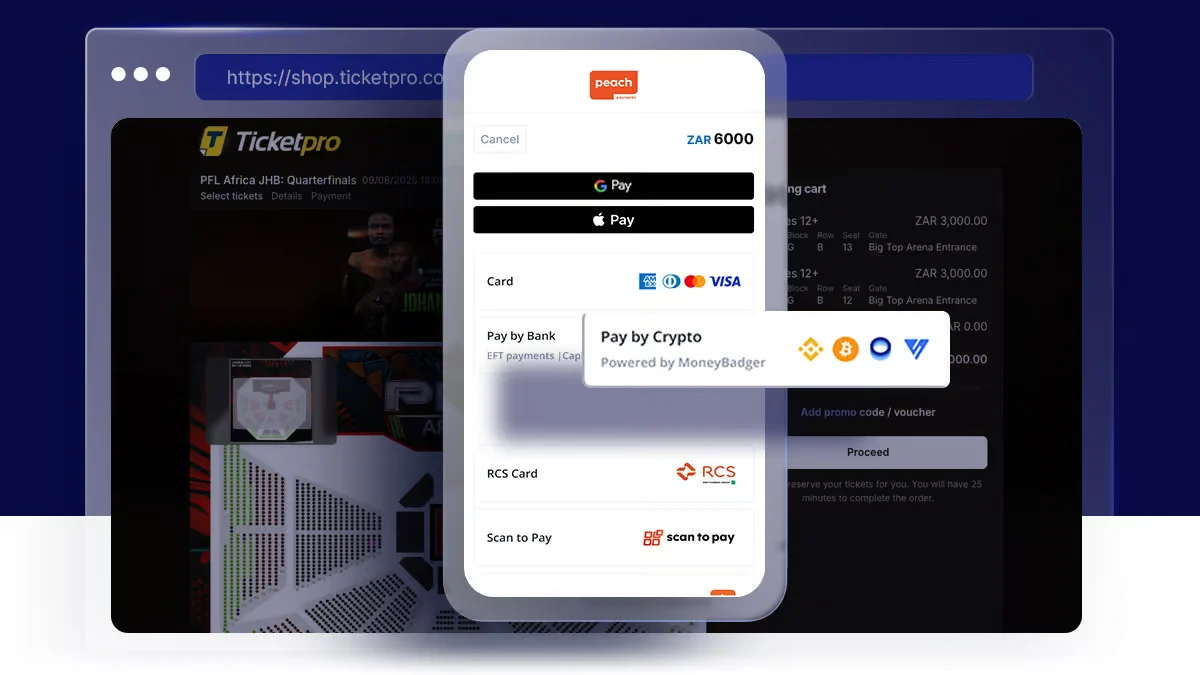

Peach Payments x MoneyBadger partnership goes live

Peach Payments launches enterprise-level POS terminal

iTickets x Peach Payments Point of Sale

Peach Payments x Digicape: Powering Premium Apple Experiences with Seamless Payments

Peach Payments acquires West-African payments gateway PayDunya

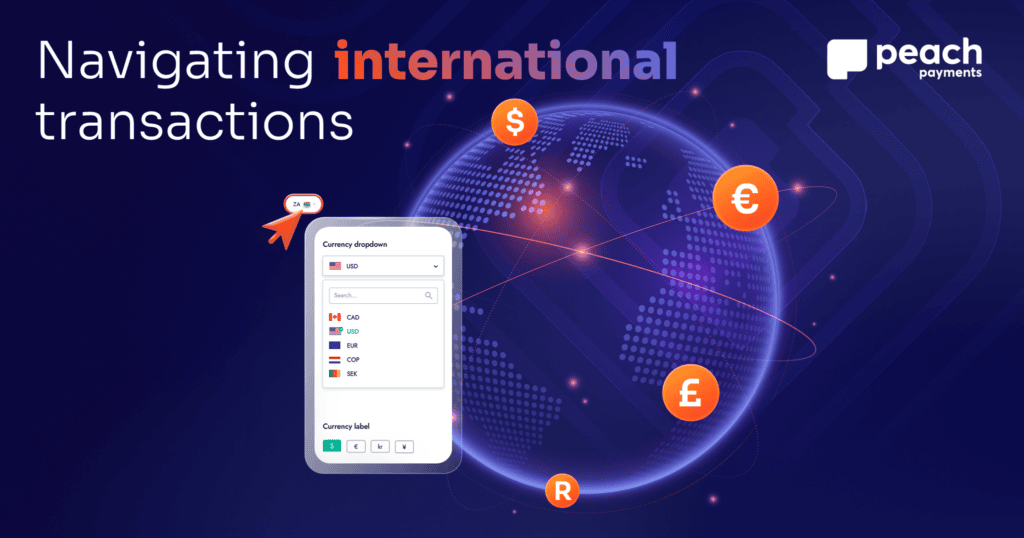

Navigating International Transactions

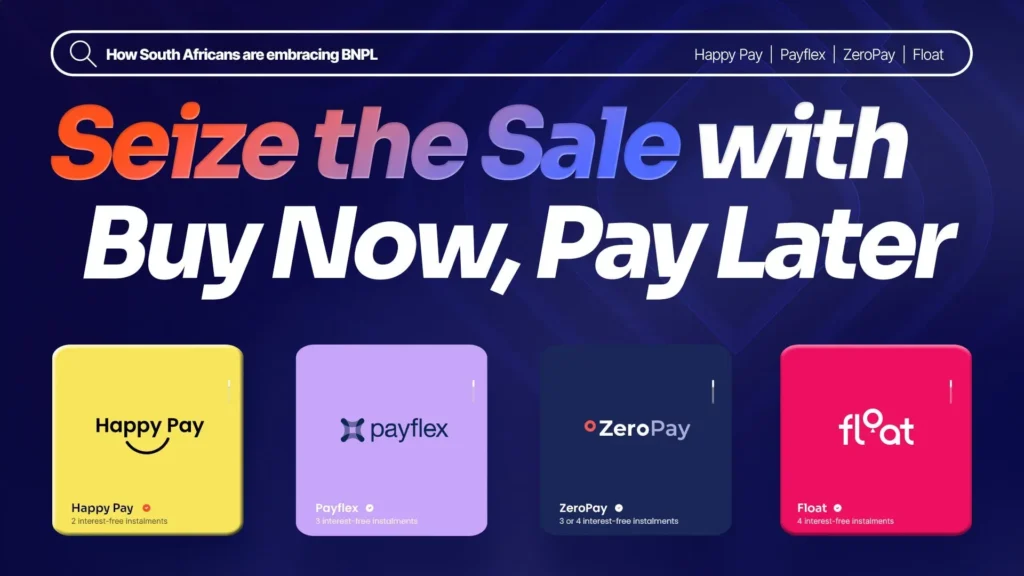

Seize the Sale with Buy Now, Pay Later

2024 Wrapped: A Year of Innovation and Growth at Peach Payments

RCS payment option now available through Peach Payments

Peach Payments sees impressive growth this Black Friday Weekend

#PeachFriday Merchant Deals 2024

Your Ultimate Guide to Payment Security for Black Friday

Scaling with Peach Payments: Unveiling the Product Roadmap

Scaling with Peach Payments: Revolutionising Reconciliation

Scaling with Peach Payments: The Future of Payments

Scaling with Peach Payments: How Peach Payments is Keeping Your Business Safe

Scaling with Peach Payments: Insights from the Think Bigger Summit 2024