Share via

Imagine your house has a safe where you store your most valuable possessions. Now, picture leaving one door to your house open. Even though the safe is locked, your valuables remain at risk because that open door compromises your home’s overall security. This illustrates the importance of securing not just your payment form (the safe) but also the entire parent page that hosts it.

This is where e-skimming attacks come into play. Even if your card capture form is secure, a vulnerability on your website can allow attackers to intercept sensitive data before it reaches your secure payment form.

The Evolution of Payment Security: From Securing the Room to Securing the Entire House

In the past, merchants relied on iframes to collect card data, which isolated the secure payment form from the rest of the website. As long as the payment form (or “the room with the safe”) was secure, vulnerabilities elsewhere on the site were less of a concern. But with the rise of sophisticated attacks like e-skimming — where malicious code is injected into the website, not the payment form — this approach is no longer sufficient.

To combat these modern threats, the Payment Card Industry (PCI) Security Standards Council introduced PCI DSS v4.0, which enforces stricter security measures for the entire website (more specifically the “parent page” hosting the card capture widget), not just the card capture widget. With these new standards, protecting your entire site is mandatory to prevent attacks like e-skimming and ensure secure payment processing.

What is PCI DSS v4.0?

PCI DSS 4.0 is designed to enhance the security of cardholder data by adopting a comprehensive approach to security measures and access controls. Merchants must now secure every part of the payment flow, ensuring not only the payment form but also the hosting web environment is protected. The deadline for full compliance with PCI DSS v4.0 is March 2025, when the future-dated requirements become mandatory.

What’s New in PCI DSS v4.0?

The Future-Dated Requirements:

- Requirement 6.4.3: Merchants must maintain a list of all scripts running on payment pages, with processes to detect and address unauthorized changes. This combats e-skimming by ensuring no rogue scripts sneak into the payment page.

- Requirement 11.6.1: Regular testing for unauthorized scripts on these pages is mandatory to prevent digital theft of sensitive payment data.

The Bottom Line: Protect the Entire House

PCI DSS v4.0 marks a shift from securing just the “safe” (payment form) to securing the entire house (your website). With new threats like e-skimming, every entry point must be fortified. The standard emphasizes a holistic approach—because if one window or door is left unsecured, everything is at risk.

The clock is ticking. March 2025 is closer than you think. Now’s the time to lock every door, window, and digital lock.

Coming Soon: Stay tuned for our next blog, where we’ll explore merchant vs. Peach Payments’ responsibilities under PCI DSS v4.0 compliance.

To learn more about how we protect merchants today, check out our Security at Scale page.<\/p>

Scale with Peach

Learn how we help scale some of Africa's most exciting businesses

Business tips, case studies, interviews with online store owners and business trends…

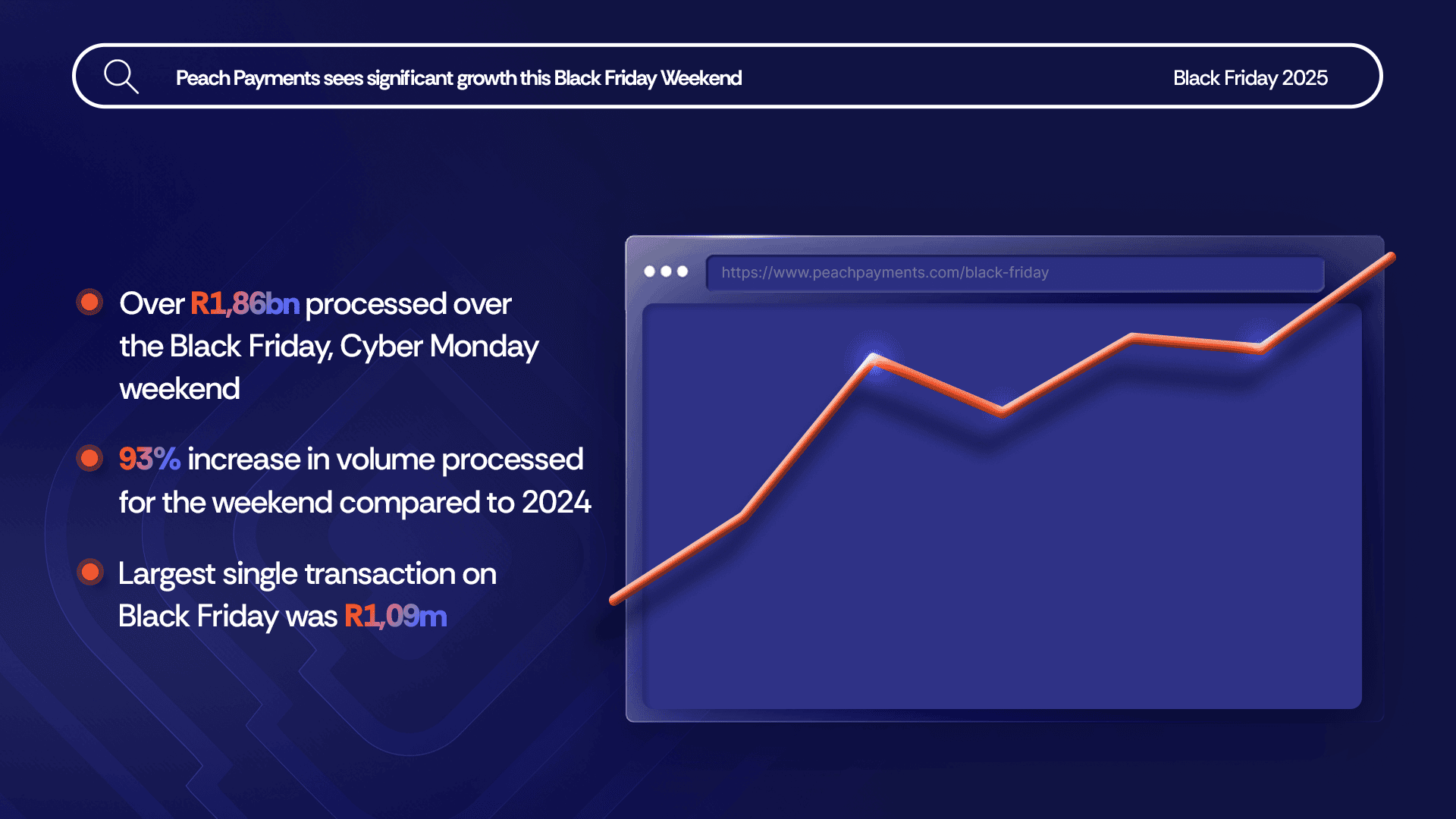

Black Friday up 93% over 2024, R1,86bn processed

Bringing Our New Peach Values to Life

Samsonite in-store payment methods

How global and regional companies can use the Mauritius IFC to centralise online payments and treasury functions

# PeachFriday Merchant Deals 2025

A merchant’s guide to chargebacks

Four Black Friday payment realities for merchants

What are Direct Merchant Accounts (ISO) versus Aggregation Accounts?

What Is 3RI? Everthing you need to know about Requestor-Initiated Authentication

Highlights from the 2025 World Wide Worx Online Retail Report

What is Interchange? Everything you need to know about interchange fees

Cadana Pay x Peach Payments: Unlocking seamless global Payouts

Peach Payments announces real-time clearance Payouts

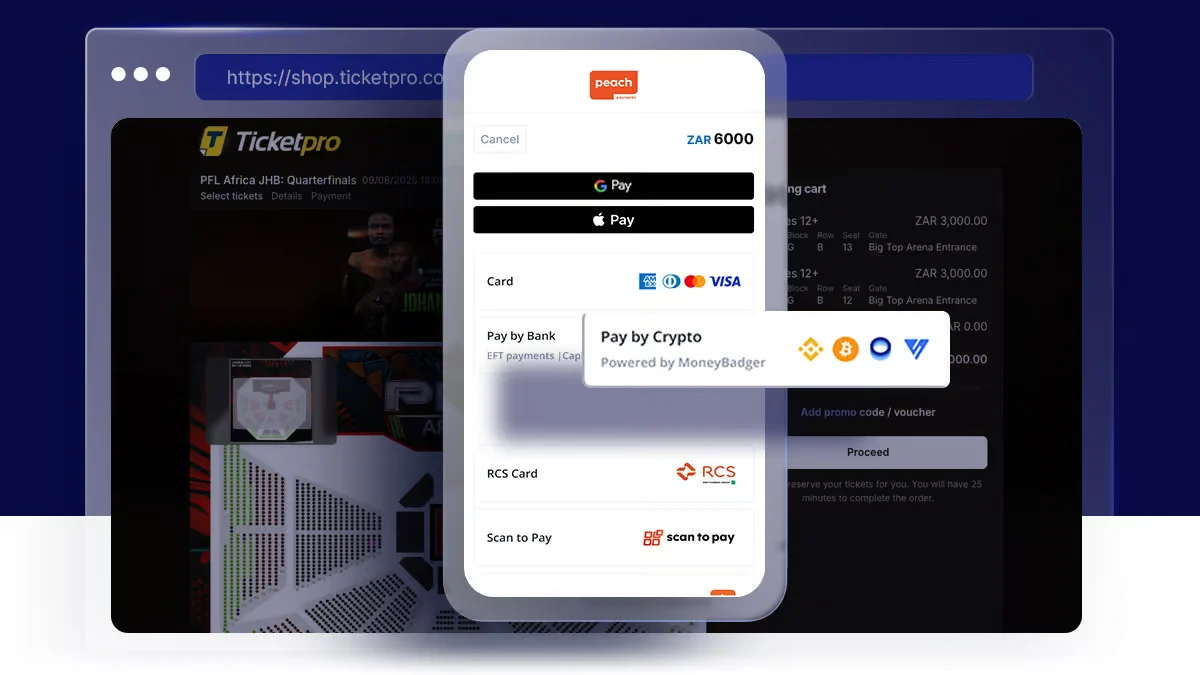

Peach Payments x MoneyBadger partnership goes live

Peach Payments launches enterprise-level POS terminal

iTickets x Peach Payments Point of Sale

Peach Payments x Digicape: Powering Premium Apple Experiences with Seamless Payments

Peach Payments acquires West-African payments gateway PayDunya

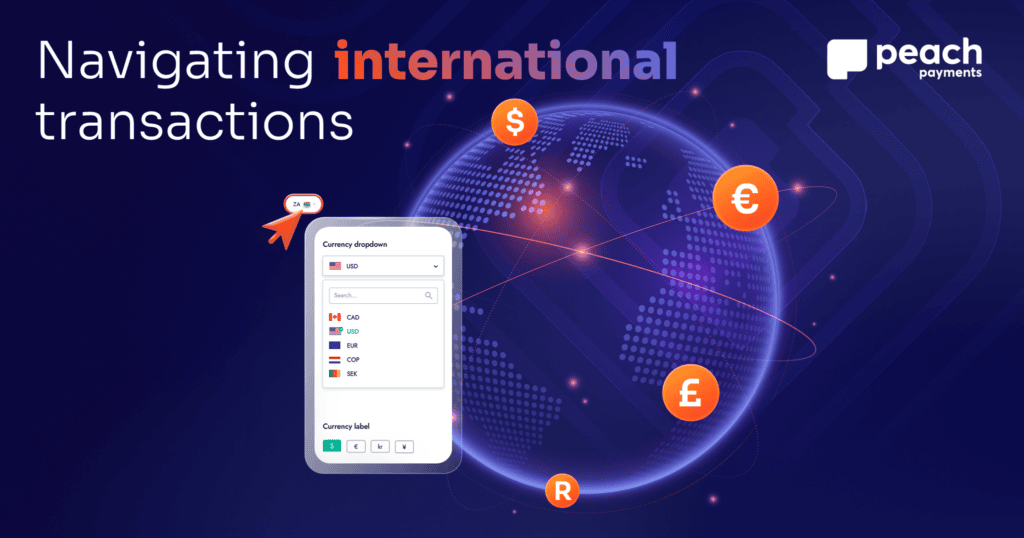

Navigating International Transactions

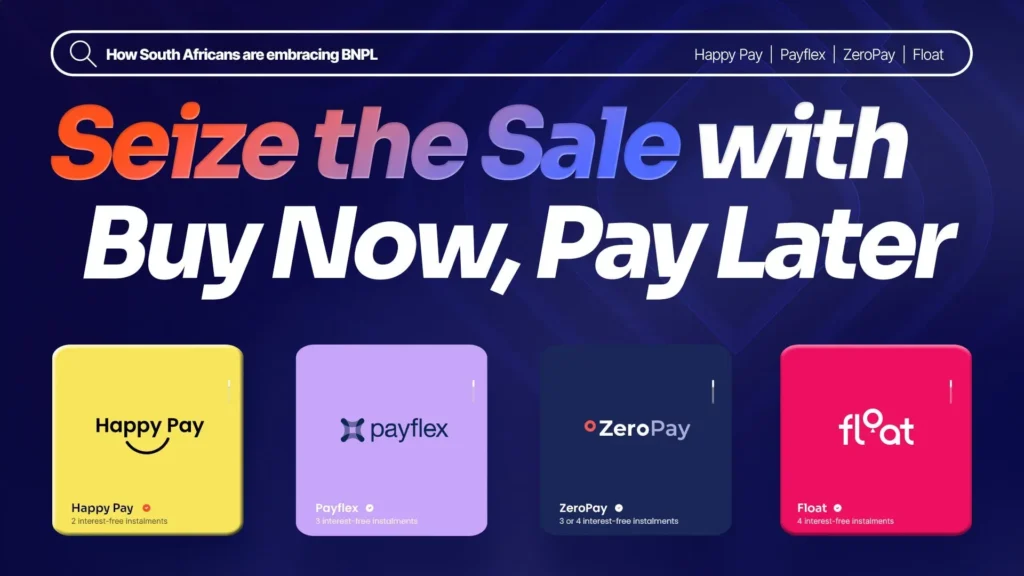

Seize the Sale with Buy Now, Pay Later

2024 Wrapped: A Year of Innovation and Growth at Peach Payments

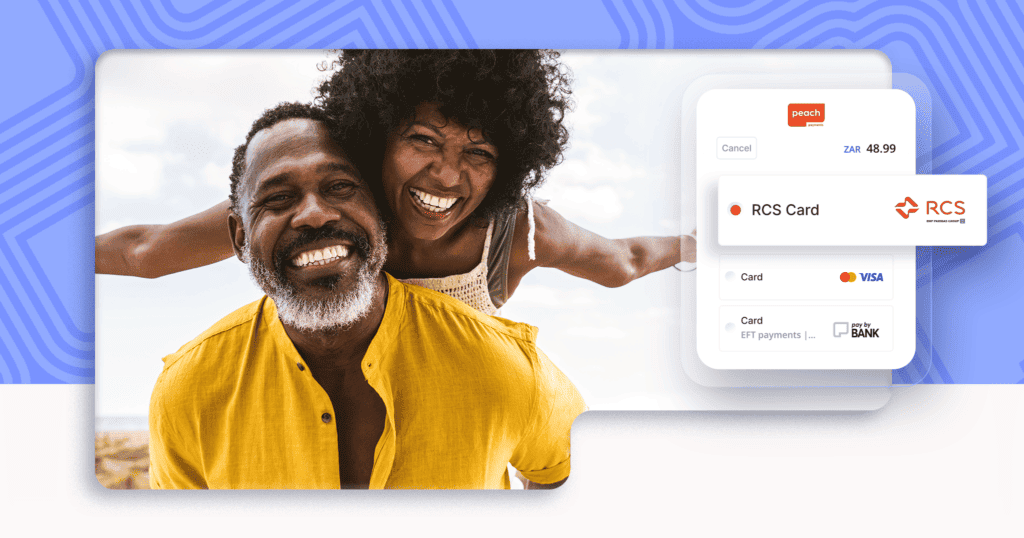

RCS payment option now available through Peach Payments

Peach Payments sees impressive growth this Black Friday Weekend

#PeachFriday Merchant Deals 2024

Your Ultimate Guide to Payment Security for Black Friday

Scaling with Peach Payments: Unveiling the Product Roadmap

Scaling with Peach Payments: Revolutionising Reconciliation

Scaling with Peach Payments: The Future of Payments

Scaling with Peach Payments: How Peach Payments is Keeping Your Business Safe

Scaling with Peach Payments: Insights from the Think Bigger Summit 2024