Share via

We all want our online businesses to reach as many people as possible, but have you considered all the ways your Shopify store could be excluding shoppers?

No, I’m not talking about your product range: a fish is never going to want to buy a raincoat. But what about those fish that found their lure on your site? It may be safe to assume you’ve got that sale in the bag.

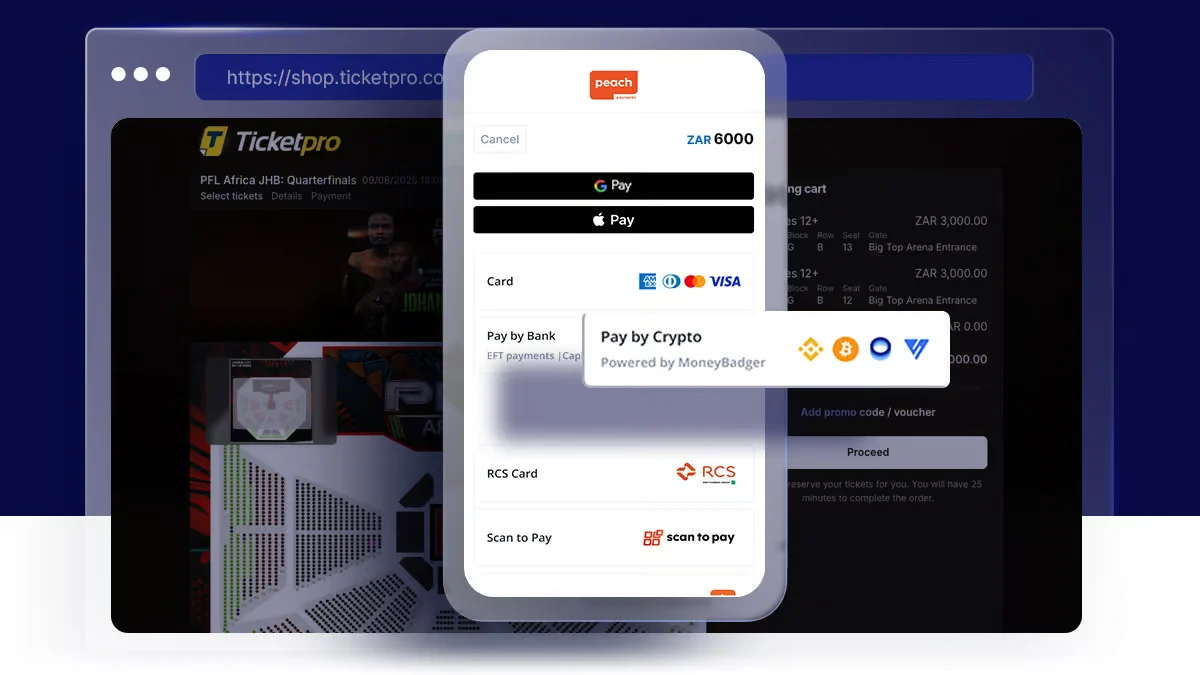

But once that basket is packed and ready to go, your customers still have hurdles to overcome: how do they pay? The easy answer: the way they want to, and it’s up to you to ensure they can. It’s easy to imagine that everyone has a debit or credit card ready to make purchases, but the wider the net, the more diverse your catch becomes. There’s a world of payment methods out there, so let’s look at all the ways you can catch that sale.

Half of online shoppers look for multiple payment methods

Not everyone is comfortable with sharing their card details online. In South Africa, debit cards make up 33% of all online transactions and credit cards a further 17% — meaning that 50% of online shoppers look for other payment methods.

Looking closer at the stats, Instant EFT makes up a further 31%, and the final 19% is made up of alternate payment methods. It’s that 19% that needs to be looked at closely. 19% is not a number that can simply be ignored — if your turnover dropped by 19%, it would definitely be a cause for concern. So turning that around, without offering a wide range of payment methods, your Shopify store could be losing up to 19% of all possible sales.

It’s a tricky 19% to capture, especially considering the wide array of payment methods that exist. ApplePay is popular among those who are more familiar with online shopping and simply enjoy the convenience of the payment method. Even though these shoppers most likely have credit and debit cards to pay with, your Shopify store will stick out as modern and extra accessible for offering it.

Alternate payment methods

Then there’s the credit and installment offerings such as Mobicred, Payflex, and ZeroPay. These payment methods experienced a sudden spike in popularity ever since COVID lockdown encouraged many South Africans to start making purchases online. Where previously shoppers would have rather gone to a brick and mortar store to make big purchases, they’re now more adjusted to buying online.

Credit

The world of credit doesn’t end at credit cards. In fact, credit providers like Mobicred can provide customers with credit during checkout. They act like any other credit provider, and let your customers get instant approval for their purchases — with no risk to you.

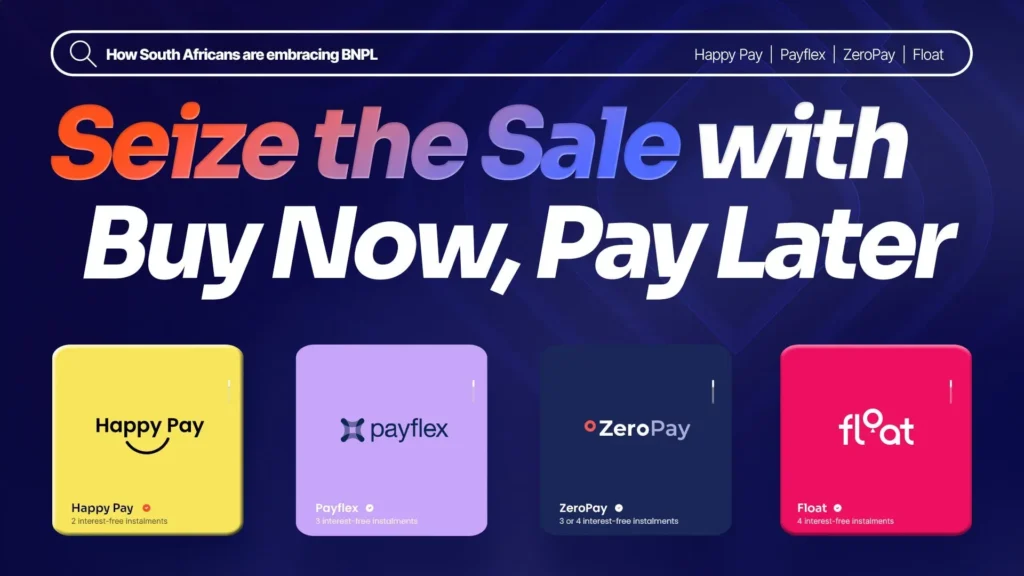

By now, pay later

Installment offerings let customers buy bigger. Customers can have purchases broken down into three installments with ZeroPay or four installments with PayFlex, interest free. Whether it’s one large item or a basket packed to the brim with smaller ones, shoppers can make purchases they would otherwise have saved up for, or purchased from month to month. We all know the benefits of retail therapy, and when the initial payment is only a quarter of the total, one can’t help but spend a little more.

Prepaid vouchers

But there’s still a payment method that needs to be considered, and as South Africa transitions into a fully digital age, it’s going to be the most important payment method to offer. 1Voucher has burst onto the scene with the biggest bang a payment method can make — and your Shopify store is going to miss an amazing opportunity to scale if you don’t offer it.

1Voucher allows customers to visit one of thousands of purchase points and buy a voucher they can redeem online. This suddenly instills a massive market with the confidence to buy online without the fear of submitting their bank card details.

Grow with payment methods

You can expect a rapid growth in online shopping in South Africa, and your Shopify store needs an online payment gateway that offers it. Don’t miss out on this massive opportunity to take your online business to the next level — connect with online payment gateways like Peach Payments and make sure you ride this new wave to success.

Watch this video on why giving your customers multiple payment options are important for your business.

Find out more about what Peach Payments can do for your Shopify store or click here to get started.

Scale with Peach

Learn how we help scale some of Africa's most exciting businesses

Business tips, case studies, interviews with online store owners and business trends…

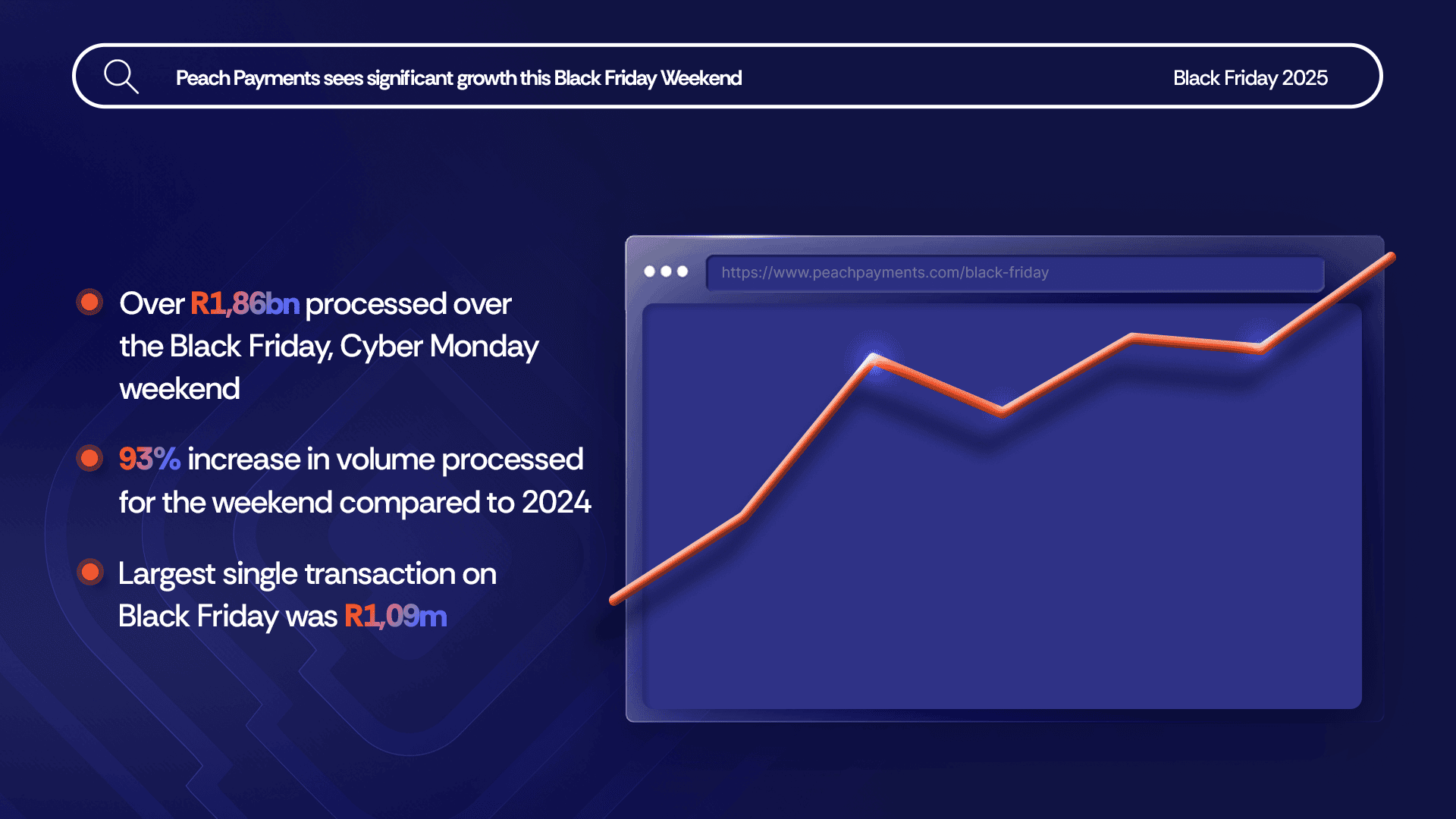

Black Friday up 93% over 2024, R1,86bn processed

Bringing Our New Peach Values to Life

Samsonite in-store payment methods

How global and regional companies can use the Mauritius IFC to centralise online payments and treasury functions

# PeachFriday Merchant Deals 2025

A merchant’s guide to chargebacks

Four Black Friday payment realities for merchants

What are Direct Merchant Accounts (ISO) versus Aggregation Accounts?

What Is 3RI? Everthing you need to know about Requestor-Initiated Authentication

Highlights from the 2025 World Wide Worx Online Retail Report

What is Interchange? Everything you need to know about interchange fees

Cadana Pay x Peach Payments: Unlocking seamless global Payouts

Peach Payments announces real-time clearance Payouts

Peach Payments x MoneyBadger partnership goes live

Peach Payments launches enterprise-level POS terminal

iTickets x Peach Payments Point of Sale

Peach Payments x Digicape: Powering Premium Apple Experiences with Seamless Payments

Peach Payments acquires West-African payments gateway PayDunya

Navigating International Transactions

Seize the Sale with Buy Now, Pay Later

2024 Wrapped: A Year of Innovation and Growth at Peach Payments

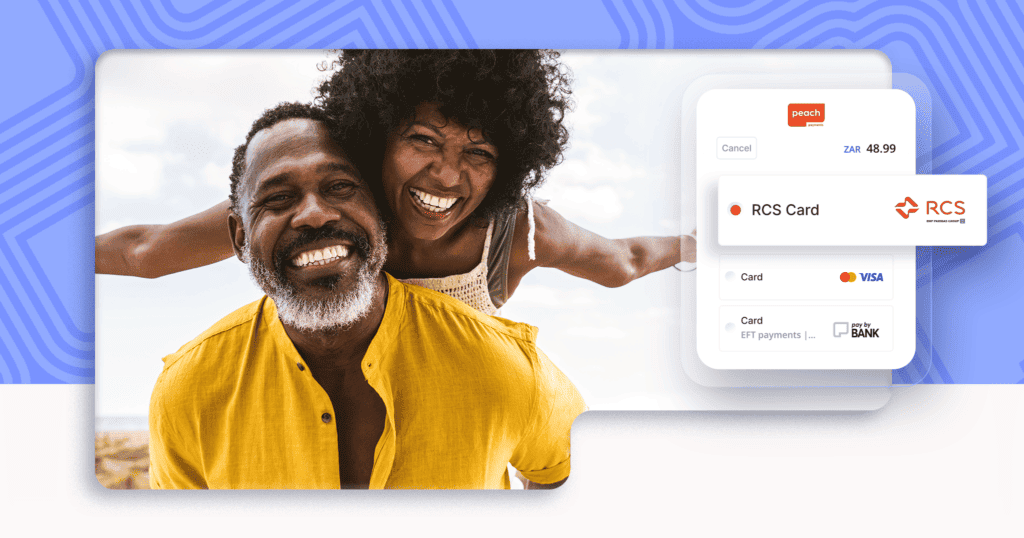

RCS payment option now available through Peach Payments

Peach Payments sees impressive growth this Black Friday Weekend

#PeachFriday Merchant Deals 2024

Your Ultimate Guide to Payment Security for Black Friday

Scaling with Peach Payments: Unveiling the Product Roadmap

Scaling with Peach Payments: Revolutionising Reconciliation

Scaling with Peach Payments: The Future of Payments

Scaling with Peach Payments: How Peach Payments is Keeping Your Business Safe

Scaling with Peach Payments: Insights from the Think Bigger Summit 2024