Share via

The online retail landscape may be evolving, but we are here to guide you with dedicated support, security at scale, and peak performance when you need it most.

Think bigger than the technology of payments: Think about a team of performance specialists that will take your customer service to the next level

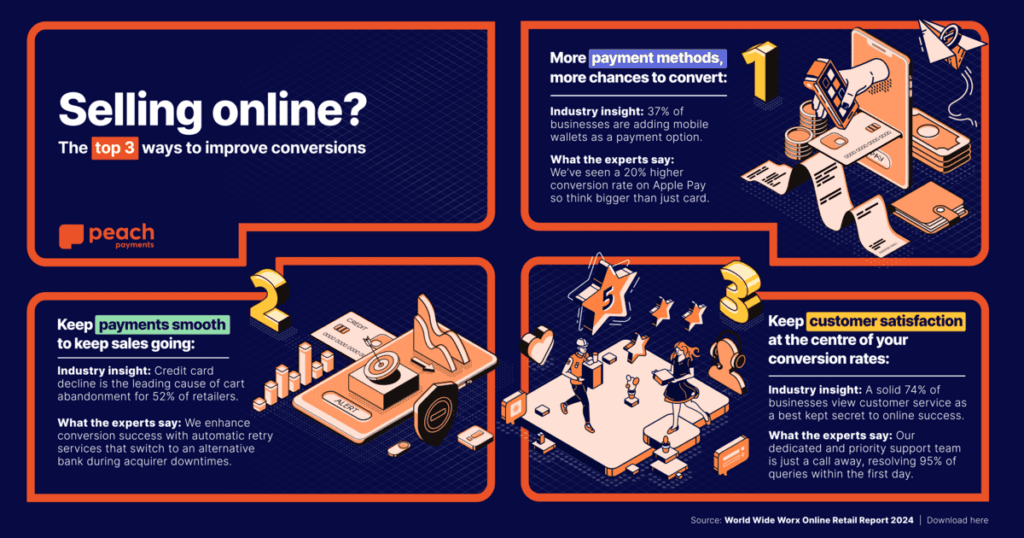

According to the WWW study, customer service ranks as the most important factor to the success of online retail activities among respondents, at 74%.

Recognised for outstanding customer service, Peach Payments differentiates itself with rapid support—resolving over 95% of issues within the first 24 hours. Each key enterprise account benefits from dedicated Account Managers who provide detailed monthly reports on conversions, customer trends, and the latest payment methods, ensuring the health of your business. Our approach goes beyond tracking failure codes by analyzing user behavior to understand and address the root causes of payment failures, setting us apart from other Payment Service Providers.

Think bigger than payments: Think trust, security and peak performance when you need it most

According to the WWW study, both trust and security are consistently rated highly across all company sizes.The stability of the system and failovers also received high ratings across all company sizes. This suggests that businesses value payment gateways that ensure trust, uninterrupted service and have robust failover mechanisms in place.

We deliver a secure and seamless shopping experience with state-of-the-art encryption and rigorous merchant screening. Our platform features robust security tools and maintains a 99.9% uptime, ensuring reliable transaction processing. In case of downtime, our automatic failover mechanism keeps your operations smooth. Uniquely, we offer free redundancy for 3D Secure transactions, emphasizing our commitment to uninterrupted service without additional costs.

Think bigger than credit cards: Offer more payment methods to increase your conversion opportunity

According to the WWW study, cards (100%) and EFT (95%) payments remain the most universally used payment methods. Alternative payment methods are also taking center stage. For Enterprises, vouchers (61%), Bnpl (47%) and Payment Links (44%) are the most utilized. Digital wallets are also on the rise, with 37% of merchants currently using Apple Pay and/or Google Wallet.

We recognise that providing a variety of payment options caters to diverse consumer needs, enhancing merchant sales. We offer insights on which methods yield the highest conversions, such as a 20% increase with Apple Pay due to less friction and no need for repeated credential entries, boosting transaction volumes by 36%. Additionally, 1Voucher is becoming popular for its ability to lower entry barriers for cash customers, showing a 75% conversion rate.

The rising trend of Buy Now, Pay Later options helps sustain sales during slow periods without increasing consumer debt. Our dedicated specialists and Account Managers use transaction data to proactively address challenges, ensuring smooth payment processes and robust recovery flows

Download the full report.

Scale with Peach

Learn how we help scale some of Africa's most exciting businesses

Business tips, case studies, interviews with online store owners and business trends…

Black Friday up 93% over 2024, R1,86bn processed

Bringing Our New Peach Values to Life

Samsonite in-store payment methods

How global and regional companies can use the Mauritius IFC to centralise online payments and treasury functions

# PeachFriday Merchant Deals 2025

A merchant’s guide to chargebacks

Four Black Friday payment realities for merchants

What are Direct Merchant Accounts (ISO) versus Aggregation Accounts?

What Is 3RI? Everthing you need to know about Requestor-Initiated Authentication

Highlights from the 2025 World Wide Worx Online Retail Report

What is Interchange? Everything you need to know about interchange fees

Cadana Pay x Peach Payments: Unlocking seamless global Payouts

Peach Payments announces real-time clearance Payouts

Peach Payments x MoneyBadger partnership goes live

Peach Payments launches enterprise-level POS terminal

iTickets x Peach Payments Point of Sale

Peach Payments x Digicape: Powering Premium Apple Experiences with Seamless Payments

Peach Payments acquires West-African payments gateway PayDunya

Navigating International Transactions

Seize the Sale with Buy Now, Pay Later

2024 Wrapped: A Year of Innovation and Growth at Peach Payments

RCS payment option now available through Peach Payments

Peach Payments sees impressive growth this Black Friday Weekend

#PeachFriday Merchant Deals 2024

Your Ultimate Guide to Payment Security for Black Friday

Scaling with Peach Payments: Unveiling the Product Roadmap

Scaling with Peach Payments: Revolutionising Reconciliation

Scaling with Peach Payments: The Future of Payments

Scaling with Peach Payments: How Peach Payments is Keeping Your Business Safe

Scaling with Peach Payments: Insights from the Think Bigger Summit 2024