Watch how South Africans are buying on Black Friday

Peach Payments today launches its Black Friday Dashboard live on its website

Read More

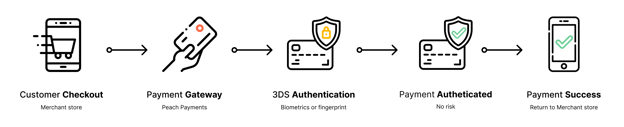

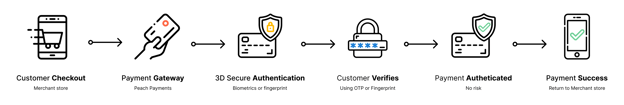

3D Secure 2.0 is the improved security method for making payments for any digital payment, including payments through your online payment gateway.

3D secure is a security protocol that adds a layer of authentication to the online payment experience by verifying a cardholder’s identity when they are using their card details instead of swiping with their actual card. The purpose is to protect a customer’s card against unauthorised use when shopping online.

The first iteration of 3DS appeared in 1999. Card networks like Visa (Verified by Visa) and Mastercard (Mastercard Identity Check) implemented this feature in 2001. In the first iteration, customers needed to authenticate themselves using OTP or One Time Password.

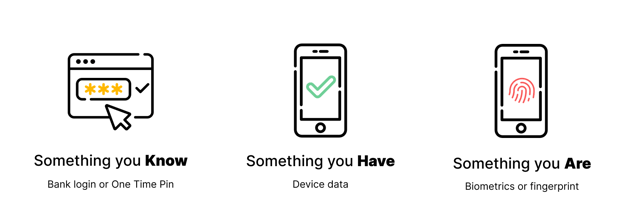

To authenticate the customer is usually required to provide something they have (device), something you know (One Time Pin), or something you are (Biometrics - like a fingerprint)

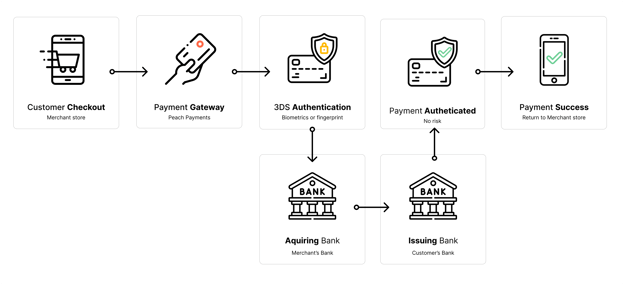

3DS involves three domains: the acquiring bank (or the merchant’s bank), the issuing bank (or the cardholder’s bank), and the infrastructure supporting this protocol, such as Peach Payments.

3DS 1.0 promised to help prevent fraud by shifting the burden of authentication onto the issuers (Customer’s bank). This led to a huge loss in false declines as customers would choose to cancel a transaction when seeing a 3DS pop-up (or more likely a redirect) to avoid any potential fraud.

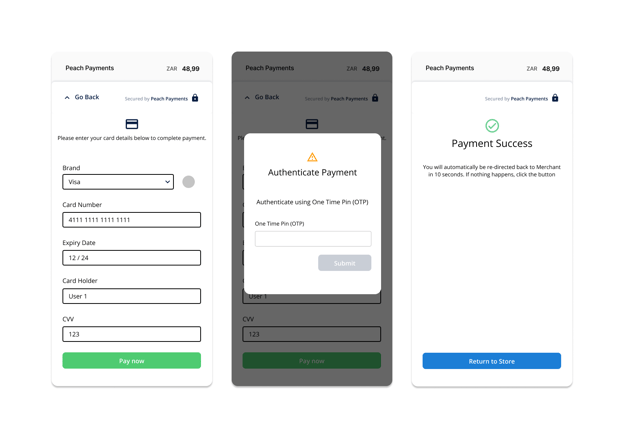

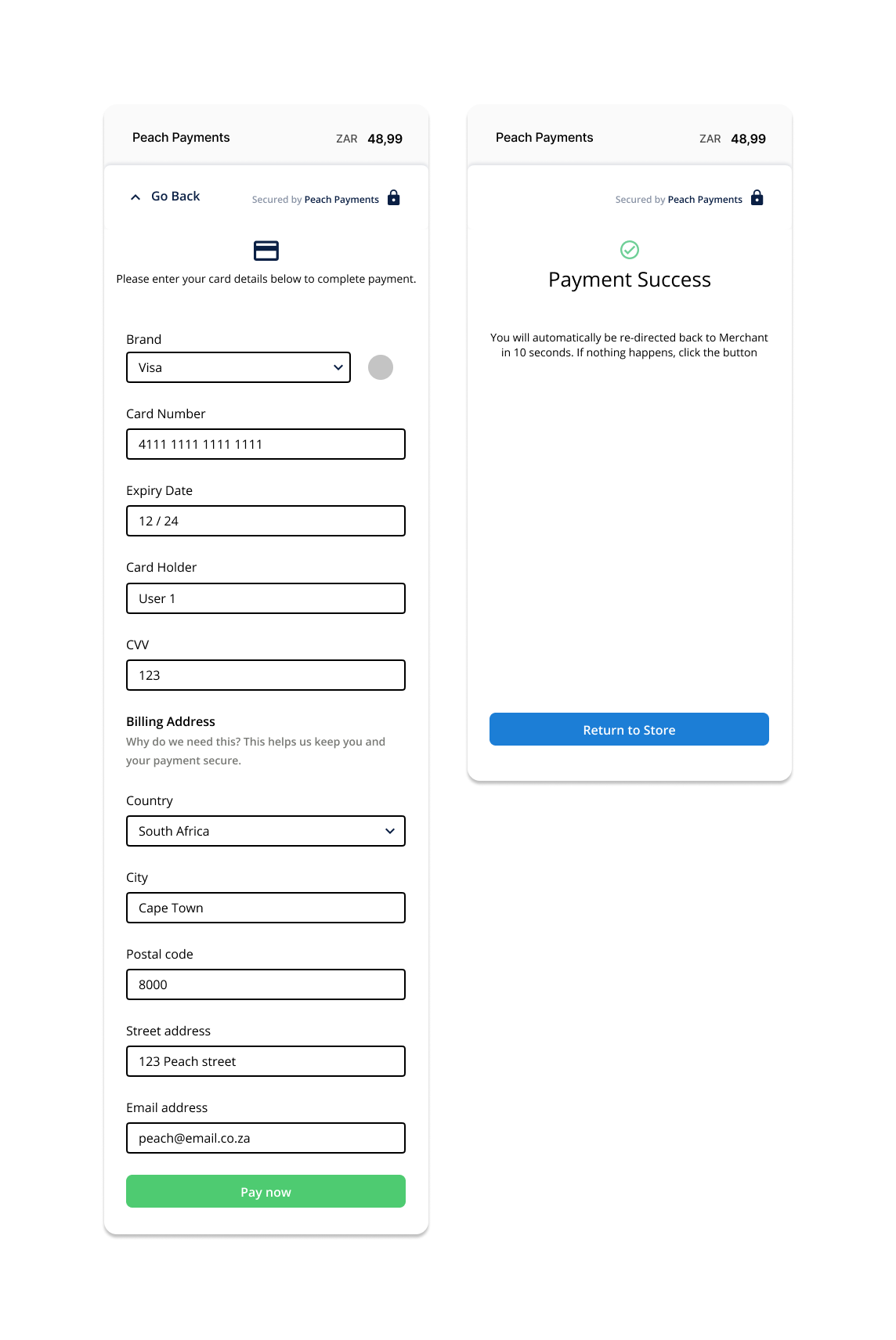

So what does 3DS look like?

You know when you buy something online and a little pop up appears asking you to enter an OTP or approve your purchase in your banking app? Yup, that’s 3DSecure in action.

3DS 2.0 offers additional fraud protection by analysing information about the customer and prompting them to verify their identity when making a high risk transaction. By assessing the customer’s information and the risk of their transaction, customer’s may not have to verify their identity to authenticate every transaction they make.

What does it look like? No extra steps, no pop ups and no OTP or fingerprint needed!

When a transaction is trusted the customer will continue on the frictionless flow (No OTP or Biometrics required to authenticate)

If a transaction is deemed suspicious or high-risk, the customer is then required to authenticate (OTP or Biometrics) in the challenge flow.

Risk-based authentication is the process of determining the risk attached to a particular transaction and, based on that risk level, whether or not the customer should be challenged.

The risk-based assessment includes:

Peach Merchants are not required to make any changes, although they do have the option to submit additional data related to customers and transactions to further improve their customer’s online purchasing experience.

So should you? It has been shown that 3DS 2.0 can increase conversion rates by almost 8%, reduce false declines and is overall a better checkout experience.

Additional data points:

Peach Payments will be supporting 3DS 2.0 by 31st October 2021 and will be expecting all Merchants to support 3DS 2.0 by 31st October 2022 as 3DS 1.0 will no longer be supported by our banks.

Peach Payments is always looking to improve our product and customer experience. 3DS 2.0 is the next step in fraud prevention and a big leap in improving the customer online purchasing experience, and upping your business’s conversion rate.

No spam. Just the latest news, ecommerce tips and tricks to help you scale your business.

.png)

Peach Payments today launches its Black Friday Dashboard live on its website

Read More

Peach Payments is paving the way for a transformative 2025. From Pay by Bank to Embedded Checkout, explore how we revolutionised payments in 2024

Read More%20-%20Compressed.webp)

South Africa-based digital payments platform Peach Payments shares weekend results

Read More

Discover the four Black Friday payment realities Enterprise merchants need to consider to build trust with customers and grow revenue with help from a world-class payment gateway.

Read More%20V2%20-%20Compressed.webp)

Peach Payments announces it's sponsorship of the Joburg Super Kings

Read More

The 2025 World Wide Worx report, sponsored by Peach Payments, Mastercard and AskAfrika, reveals that convenience is now the benchmark, trust is the currency and payments are the bridge.

Read More.png)

.png)

.png)

.png)

.png)