Share via

Simply put, an interchange fee is a transaction fee that a merchant’s bank (the acquiring bank) pays to the customer’s bank (the issuing bank) every time a card is used. This fee compensates the issuing bank for the costs and risks of providing a payment card, like running rewards programs, providing credit, handling accounts, and preventing fraud. This compensation also acts as an incentive for issuing banks to promote card usage, which in turn encourages cardholders to transact electronically, benefiting the broader payment network.

In South Africa, the interchange is determined by the South African Reserve Bank (SARB). The SARB periodically undertakes a project to evaluate and determine the interchange. In other African markets, issuing banks and card schemes have more flexibility and control of the interchange fee.

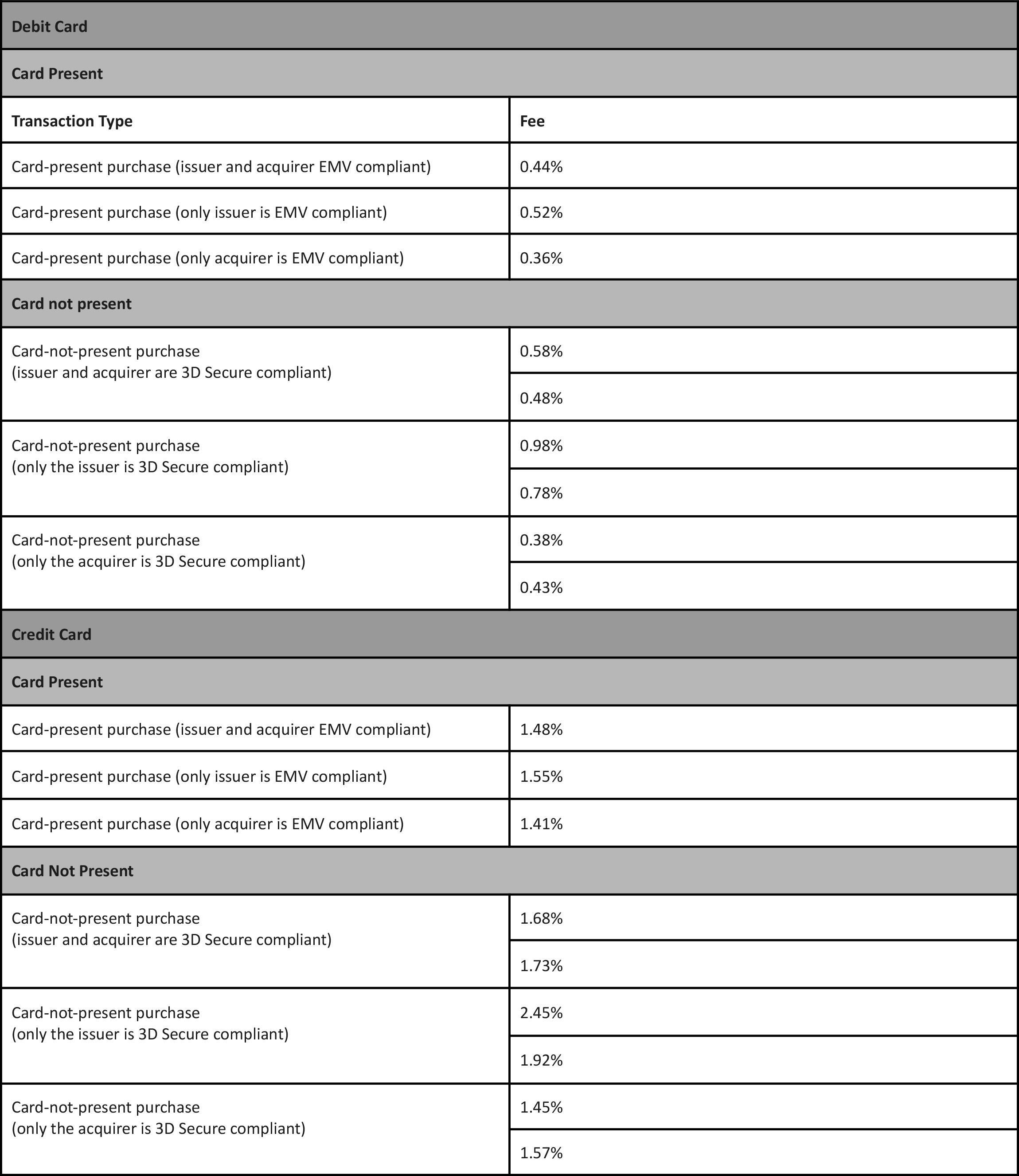

Current interchange rates in South Africa are:

Calculating the Merchant Transaction Fee: A Breakdown for My Son 🤓

Imagine you’re running your first online business, let’s say “Luke’s Cool Gadgets.” A customer buys a drone for R1,000 using a credit card.

You don’t directly pay the interchange fee. Instead, you pay a single, all-inclusive fee to your payment processor. This fee is known as the Merchant Service Charge (MSC) or Merchant Discount Rate (MDR).

The MDR can vary a lot and a number of factors help acquirers and PSPs determine this pricing:

- Merchant category: Retail, Betting & Gaming, Travel, Insurance etc.

- Value of transactions per month

- Average transaction value

- Transaction flows: 3D Authenticated vs not authenticated, In-person vs e-commerce and so on

Let’s assume your MDR is 2.5% for credit cards. Now Interchange as defined by the SARB in South Africa is 1.68% for 3D Authenticated transactions. So this means that for your R1000 order you pay:

2.5% @ 1000 = R25. From the R25, 1.68% or R16.80 is paid to the issuing bank. That leaves 2.5% – 1.68% = 0.82% for process costs to be divided amongst the various participants in the merchant acquisition chain, namely:

- Card Schemes Margin

- Acquirer Margin

- PSP Margin

South African Perspective

In South Africa, the payment ecosystem is mature and highly regulated. The South African Reserve Bank (SARB) plays a direct role in setting and revising interchange fees through its ongoing Interchange Determination Project (IDP), ensuring a fair and efficient National Payment System. This unique regulatory environment provides a level of stability and fairness for merchants.

Scale with Peach

Learn how we help scale some of Africa's most exciting businesses

Business tips, case studies, interviews with online store owners and business trends…

Black Friday up 93% over 2024, R1,86bn processed

Bringing Our New Peach Values to Life

Samsonite in-store payment methods

How global and regional companies can use the Mauritius IFC to centralise online payments and treasury functions

# PeachFriday Merchant Deals 2025

A merchant’s guide to chargebacks

Four Black Friday payment realities for merchants

What are Direct Merchant Accounts (ISO) versus Aggregation Accounts?

What Is 3RI? Everthing you need to know about Requestor-Initiated Authentication

Highlights from the 2025 World Wide Worx Online Retail Report

What is Interchange? Everything you need to know about interchange fees

Cadana Pay x Peach Payments: Unlocking seamless global Payouts

Peach Payments announces real-time clearance Payouts

Peach Payments x MoneyBadger partnership goes live

Peach Payments launches enterprise-level POS terminal

iTickets x Peach Payments Point of Sale

Peach Payments x Digicape: Powering Premium Apple Experiences with Seamless Payments

Peach Payments acquires West-African payments gateway PayDunya

Navigating International Transactions

Seize the Sale with Buy Now, Pay Later

2024 Wrapped: A Year of Innovation and Growth at Peach Payments

RCS payment option now available through Peach Payments

Peach Payments sees impressive growth this Black Friday Weekend

#PeachFriday Merchant Deals 2024

Your Ultimate Guide to Payment Security for Black Friday

Scaling with Peach Payments: Unveiling the Product Roadmap

Scaling with Peach Payments: Revolutionising Reconciliation

Scaling with Peach Payments: The Future of Payments

Scaling with Peach Payments: How Peach Payments is Keeping Your Business Safe

Scaling with Peach Payments: Insights from the Think Bigger Summit 2024